Olympic Games 2024 : renting out your main residence

![]()

Reminder of choices

With the Paris 2024 Olympic Games, you’re wondering whether to rent out all or part of your main residence.

As the owner of my main residence, I’m not legally allowed to rent it out for more than 120 days a year. What’s more, we’re going to see that there are certain procedures and obligations linked to this activity that must be respected.

In Paris, short-term rentals are only possible

- if it’s your main residence. In other words, the residence must be occupied for at least 8 months a year, and therefore rented for less than 120 days a year.

- if it is a commercial property.

It is forbidden for second homes, unless you obtain a Change of Use authorization.

The procedure to follow

- Have your REGISTRER NUMBER

Before starting your business, you have been required to file your furnished tourist accommodation declaration online and obtain a registration number. Rental platforms like AirBnb will need this registration number. No ad can be published on a digital platform without a registration number, on pain of prosecution and a fine.

This declaration immediately generates a registration number. Here is the link to complete the formality

- Have your SIRET NUMBER

You need to register with Insee’s Sirène directory via the INPI website. Once registered, you will be assigned a SIRET number, which will enable the tax authorities to identify you.

- Tax and social security obligations

In May 2025, you will have to declare rental income earned in 2024. They will be taxed in the industrial and commercial profits (BIC) category, either under the micro-BIC regime, or under the actual regime. In the latter case, the services of a chartered accountant are required.

Culture Patrimoine can help you choose the most useful plan for your situation.

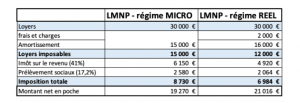

An example :

=> tax gain per year : 1,7k €

If your rental income exceeds €23,000, you must register with the “Social Security” (healthcare) and pay social security contributions.

- Other points

-

- You are free to set the rent. Rent control does not apply to tourist rentals.

- If the main residence are owned by a co-ownership, the co-ownership regulations may prohibit seasonal activity, or at least limit it. If this is not the case, the agreement of the co-ownership’s general assembly may be required.

- Renting out a second home or rental property

There are other formalities to complete. Please refer to our article on completing them.

Culture Patrimoine : your contact

For 20 years, Culture Patrimoine’s mission has been to save its clients both time and money by providing great family office services.

Culture Patrimoine is an independent company among the leaders in its market:

• Customer satisfaction rate of 95% (August 2021)

• ISO 22222 by AFNOR (4 companies out of 5800 in November 2013)

• Speaker at Francis Lefebvre Formation and the groupe Revue Fiduciaire since 2006

• +300 million euros of financial assets under management (November 2021)

The family office services provided by Culture Patrimoine are a true 360° view of all related themes (protection, finance, taxation, real estate and legal).

This support comes in the long run and starts with a consulting period, followed by implementation when appropriate.

Article rédigé le 13 décembre 2023 par Camille Giroudon.